News

Kwanika Copper Corporation Drills 392 metres of 0.53% Cu, 0.41 g/t Au (1.54 g/t AuEq) Including 130 metres of 0.64% Cu, 0.88 g/t Au (2.25 g/t AuEq) at Kwanika

December 5, 2018

Vancouver, B.C., December 05, 2018. Serengeti Resources Inc. (SIR: TSX-V) ("Serengeti" or "the Company") is pleased to report the third and final batch of assay results from the 2018 drilling campaign completed at the Kwanika Project in north-central BC. The fully funded 2018 drilling program is part of the ongoing Kwanika Pre-Feasibility Study (“PFS”) scheduled for completion in mid-2019, as described in Serengeti Resources’ press release dated September 11th, 2018. Kwanika Copper Corporation (“KCC”), is a private company jointly owned by SERENGETI RESOURCES Inc. (65%) and POSCO DAEWOO Corporation (35%).

“These are the final drill results from our very successful 2018 Kwanika drilling program. I’m delighted that the drilling has confirmed what we’ve suspected for a while; that there’s a higher-grade core to the Central Zone porphyry which should allow both the open pit and underground operations to access elevated gold and copper grades early on in the mine plan. The new drill data will be merged with the historic drill results and a greatly improved geological model, to generate a new resource model for the Central Zone, which we anticipate should be ready in the new year. And as I have previously indicated, the new resource model -along with newly gathered engineering data and metallurgical test work currently underway- are key inputs to the Pre-Feasibility Study which should be completed mid-2019” stated David W Moore, President & CEO of Serengeti and President of Kwanika Copper Corp.

Project Highlights

- K-188: 0.54% Cu, 0.62 g/t Au, 2.02 g/t Ag (1.75 g/t AuEq) over 238.5m, from 363.5 to 602.0m

- Including 0.66% Cu, 0.82 g/t Au, 2.25 g/t Ag (2.23 g/t AuEq) over 155.2m, from 363.5 to 518.7m

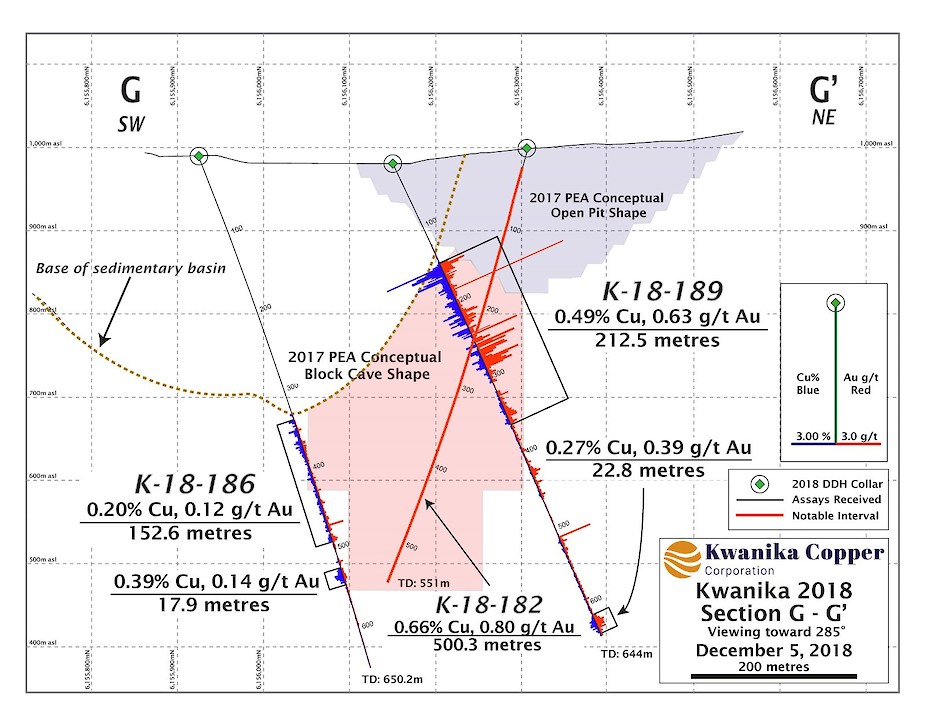

- K-189: 0.49% Cu, 0.63 g/t Au, 1.70 g/t Ag (1.66 g/t AuEq) over 212.5m, from 150.1 to 362.6m

- Including 0.68% Cu, 0.81 g/t Au, 2.26 g/t Ag (2.26 g/t AuEq) over 138.0m, from 150.1 to 288.1m

- K-190: 0.53% Cu, 0.41 g/t Au, 1.98 g/t Ag (1.54 g/t AuEq) over 392.6m, from 80.5 to 473.1m

- Including 0.65% Cu, 0.88 g/t Au, 2.49 g/t Ag (2.25 g/t AuEq) over 130.5m, from 342.6 to 473.1m

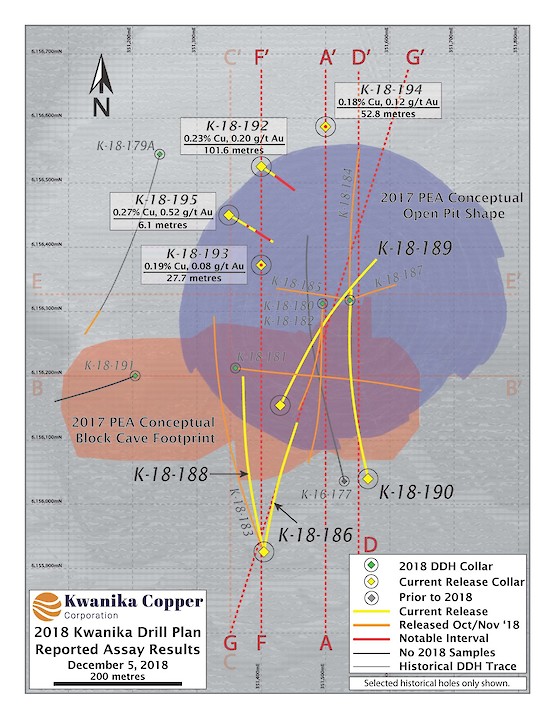

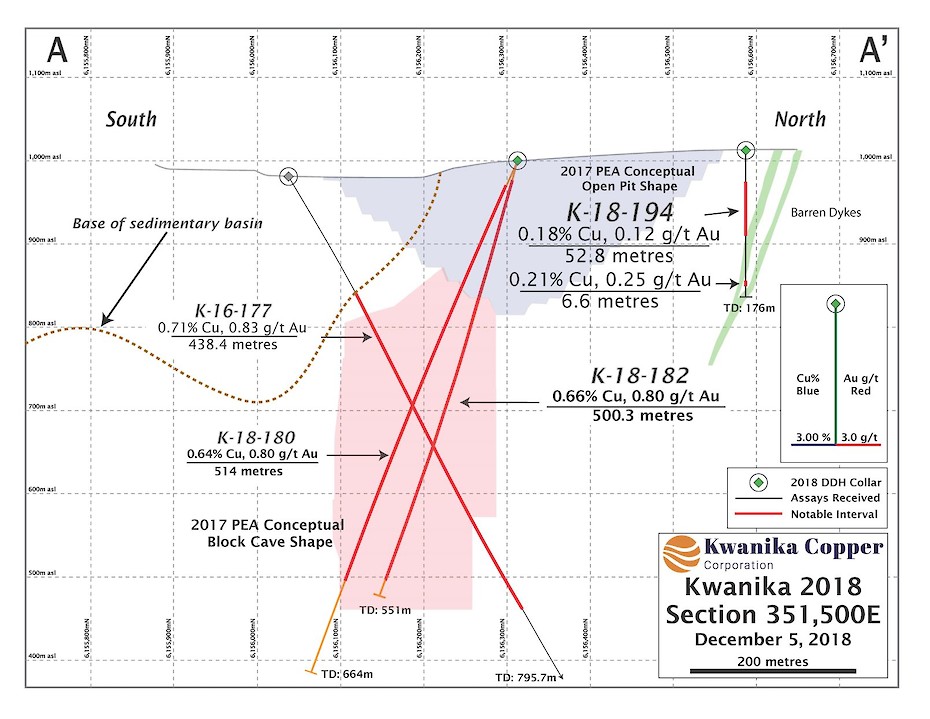

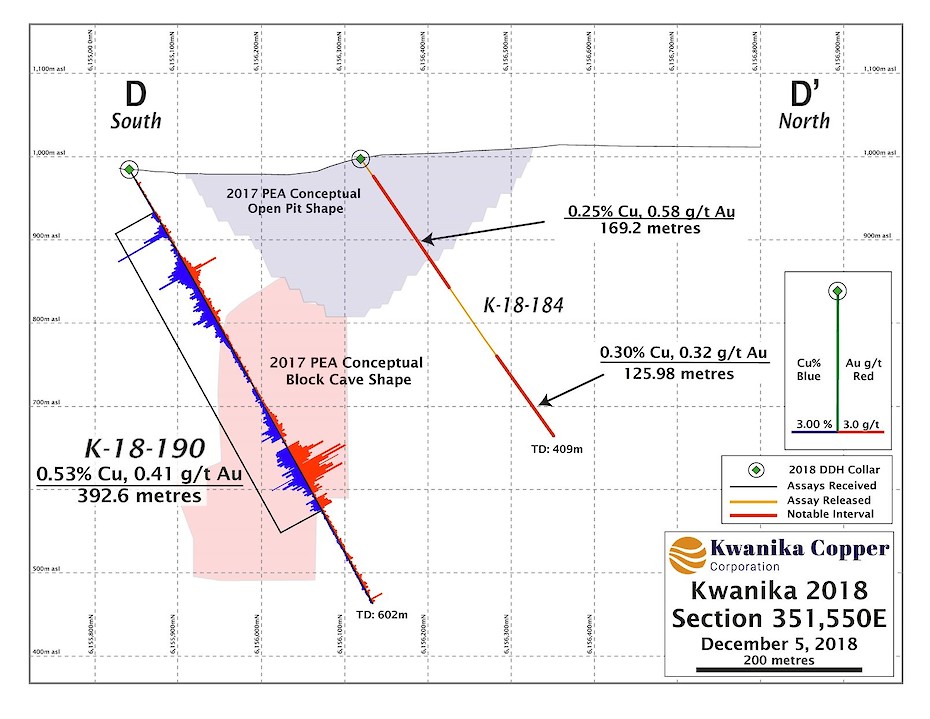

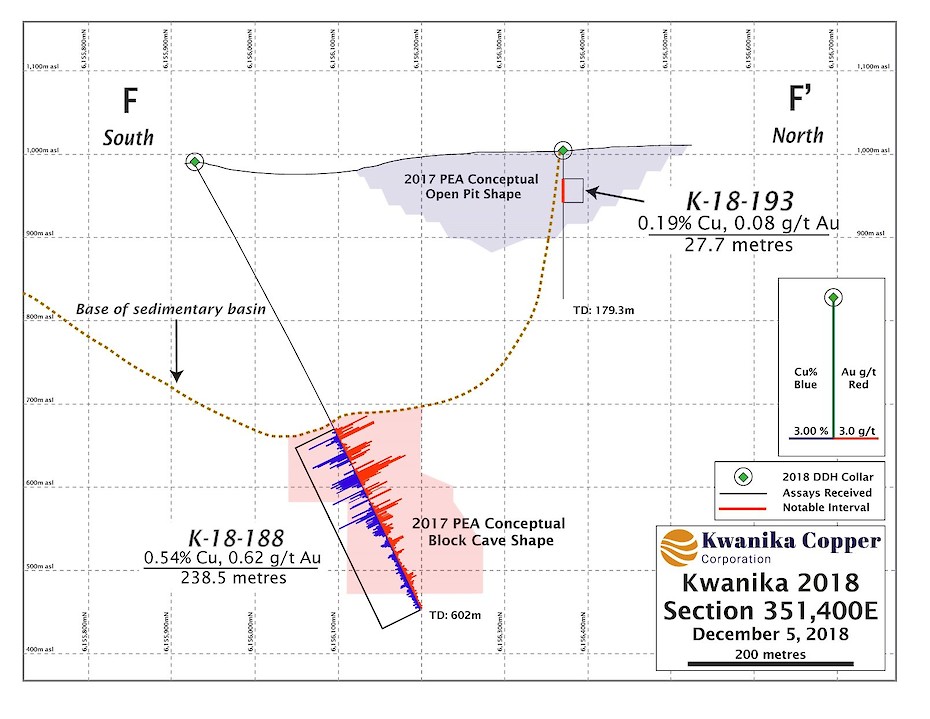

See attached plan and drill sections or view them on the company’s website at https://www.serengetiresources.com/projects/kwanika/.

|

Table 1: Kwanika Drill Program - Reported Analytical Results Current Release |

||||||||||

|

Hole |

Interval |

From (m) |

To (m) |

Interval (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

AuEq (g/t) |

Comments |

|

K-186 |

Interval |

339.3 |

491.9 |

152.6 |

0.20 |

0.12 |

1.16 |

0.26 |

0.55 |

S edge UG domain |

|

and |

526.0 |

543.9 |

17.9 |

0.39 |

0.14 |

1.31 |

0.47 |

0.97 |

||

|

K-188 |

Interval |

363.5 |

602.0* |

238.5 |

0.54 |

0.62 |

2.02 |

0.84 |

1.75 |

UG Domain |

|

Includes |

363.5 |

518.7 |

155.2 |

0.66 |

0.82 |

2.25 |

1.07 |

2.23 |

UG Domain |

|

|

K-189 |

Interval |

150.1 |

362.6 |

212.5 |

0.49 |

0.63 |

1.70 |

0.80 |

1.66 |

UG Domain |

|

Includes |

150.1 |

288.1 |

138.0 |

0.68 |

0.81 |

2.26 |

1.09 |

2.26 |

May extend OP Domain |

|

|

Includes |

150.1 |

172.0 |

21.9 |

1.61 |

0.76 |

3.67 |

1.99 |

4.15 |

UG Domain. |

|

|

Interval |

412.4 |

459.6 |

48.3 |

0.05 |

0.21 |

0.27 |

0.15 |

0.30 |

N of UG domain |

|

|

Interval |

511.3 |

534.4 |

23.1 |

0.07 |

0.36 |

0.42 |

0.25 |

0.52 |

N of UG Domain |

|

|

Interval |

617.0 |

639.8 |

22.8 |

0.27 |

0.39 |

0.71 |

0.46 |

0.95 |

N of UG Domain. |

|

|

K-190 |

Interval |

80.5 |

473.1 |

392.6 |

0.53 |

0.41 |

1.98 |

0.74 |

1.54 |

May extend OP, UG |

|

Includes |

80.5 |

239.0 |

158.5 |

0.67 |

0.24 |

2.48 |

0.80 |

1.67 |

May extend OP |

|

|

And |

342.6 |

473.1 |

130.5 |

0.64 |

0.88 |

2.49 |

1.08 |

2.25 |

UG Domain |

|

|

Includes |

387.4 |

451.4 |

64.0 |

0.85 |

1.46 |

3.35 |

1.57 |

3.27 |

UG Domain |

|

|

Interval |

476.5 |

602.0* |

125.5 |

0.06 |

0.13 |

0.34 |

0.13 |

0.26 |

Below UG Domain |

|

|

K-192 |

Interval |

71.7 |

173.3* |

101.6 |

0.23 |

0.20 |

1.09 |

0.33 |

0.68 |

May extend OP |

|

Includes |

71.7 |

85.1 |

13.4 |

0.40 |

0.13 |

1.58 |

0.47 |

0.97 |

||

|

and |

98.3 |

167.0 |

68.7 |

0.24 |

0.25 |

1.21 |

0.37 |

0.77 |

||

|

K-193 |

Interval |

35.5 |

63.2 |

27.7 |

0.19 |

0.08 |

1.47 |

0.24 |

0.50 |

OP |

|

K-194

|

Interval |

38.5 |

91.3 |

52.8 |

0.18 |

0.12 |

0.74 |

0.24 |

0.50 |

May extend OP |

|

Interval |

157.5 |

164.1 |

6.6 |

0.21 |

0.25 |

0.72 |

0.34 |

0.70 |

N of OP |

|

|

K-195 |

Interval |

72.9 |

79.0 |

6.1 |

0.27 |

0.52 |

2.02 |

0.54 |

1.12 |

W of OP |

|

Interval |

111.9 |

176.8 |

64.9 |

0.14 |

0.11 |

0.77 |

0.20 |

0.42

|

||

Intercept lengths in the table above are not necessarily true widths given the fact that holes are being drilled at different angles through forecast mining shapes within a variably oriented mineralized body. Gold and Copper equivalents are calculated using the formulae below based on metal prices of $3.00/lb of copper, $1,200/oz of gold and $15/oz of silver, with all metal prices quoted in USD. Metal recoveries as stated in the PEA as follows; Cu 91%, Au 75%, Ag 75% have been applied to the equivalent calculations..* End of Hole.

AuEq = Augpt + ((Aggpt/31.1034*AgPrice*AgRecovery)+(Cu%*CuPrice*CuRecovery*22.0462))/(Augpt/31.1034*AuPrice*AuRecovery)

CuEq = Cu% + ((Augpt/31.1034*AuPrice*AuRecovery)+(Aggpt/31.1034*AgPrice*AgRecovery))/(CuPrice*CuRecovery*22.0462)Open pit (OP), and Underground (UG) domains are as outlined in the Company’s NI-43-101 Technical Report for the Kwanika Property, Preliminary Economic Assessment Update 2017, dated 19 April, 2017 and filed on SEDAR and on the Company’s website.

|

Table 2: Kwanika Drill Hole Parameters |

|||||||

|

Hole number |

Azimuth (degrees) |

Dip (degrees) |

Length (m) |

Elevation (m) |

UTM E |

UTM N |

Purpose |

|

K-186 |

009 |

-68.1 |

650.2 |

990.8 |

351410 |

6155923 |

Test to S of cave extraction level |

|

K-188 |

345.9 |

-61 |

602 |

990.8 |

351409 |

6155922 |

Test W cave |

|

K-189 |

024.8 |

-65 |

644 |

996.1 |

351434 |

6156155 |

Test to the N of tall cave |

|

K-190 |

347.5 |

-60 |

602 |

986.4 |

351568 |

6156035 |

Test tall cave E side |

|

K-192 |

125 |

-70 |

173.3 |

1013 |

351400 |

6156525 |

Test NW edge of OP |

|

K-193 |

000 |

-90 |

179.3 |

1006 |

351400 |

6156373 |

Test W edge of OP |

|

K-194 |

000 |

-90 |

176 |

1013 |

351500 |

6156587 |

Test N edge of OP |

|

K-195 |

120 |

-65 |

197.3 |

1011 |

351350 |

6156450 |

Test NW edge of OP |

DDH-K-186 was drilled to the north-northeast from the south side of the Central Zone in order to test the southern edge of the cave at the underground extraction level. K-186 drilled through post-mineral sediments, with the hole steepening so that it encountered generally lower grade supergene and hypogene mineralization on the south fringe of the underground shape.

DDH-K-188 was drilled northward from the south side of the Central Zone in order to test the westward lateral extension of mineralization intersected in K-16-177. K-188 crossed the supergene enrichment zone and transitioned into chalcocite-dominant mineralization before intersecting hypogene sulphide mineralization in quartz-veined monzonite, remaining mineralized to the end of hole.

DDH-K-189 was drilled steeply to the north-northeast in order to test the northern face of the PEA conceptual underground shape. K-189 drilled through a high-grade supergene chalcocite-enrichment zone encountered closer to surface than anticipated, followed by hypogene mineralization comprising quartz-vein hosted pyrite-chalcopyrite-bornite within potassic altered monzonite. Several gold-anomalous intervals continued at depth into the footwall, north of the PEA conceptual underground shape.

DDH-K-190 was drilled from the south, northwards across the full width of the PEA underground shape towards its eastern end. K-190 intersected significant copper-gold mineralization closer to surface than expected and may extend the open-pit to the south. The hole continued through hypogene monzonite hosting quartz-pyrite-chalcopyrite-bornite stockwork with locally strong gold grades within the conceptual underground shape and ended in a broad gold-anomalous mineralized halo in the footwall.

DDH-K-192 – K-195 were drilled along the north and northwest margins of the PEA conceptual open pit shape in order to test the currently proposed pit limits and improve certainty of the resource. All holes intercepted variable lengths of copper-gold mineralization and K-194 drilled along several splays of a 10-metre wide, subvertical, post-mineral dyke.

About Serengeti Resources Inc.

Serengeti is a mineral exploration company managed by an experienced team of professionals with a solid track record of exploration success. The Company is currently advancing its Kwanika copper-gold project in partnership with POSCO DAEWOO Corporation and exploring its extensive portfolio of properties in north-central British Columbia. A number of these other projects are available for option or joint venture and additional information can be found on the Company’s website at www.serengetiresources.com.

Quality Assurance/Quality Control

Sample analysis for the 2018 Kwanika drilling program was completed at Bureau Veritas Minerals Laboratory in Vancouver, BC, which is ISO 9001:2015 and 17025 accredited. A robust quality assurance/quality control program was completed by KCC which included inserting field blanks, standards and duplicates into the sample stream before being shipped to the laboratory. QAQC samples accounted for a minimum of 20% of the samples which were analyzed in addition to the laboratory’s own quality assurance program. Copper and silver analyses were determined by AQ 270 which is a combined ICP-ES/MS method following Aqua-Regia digestion and is capable of determining up to 100,000 ppm Cu and 1,000 ppm Ag; Au was determined by FA430, a lead collection, Fire Assay/AAS method using a 30-gram sub-sample and has an upper detection limit of 10 ppm Au. The field program was supervised by Serengeti Resources Inc. staff and the technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101, and reviewed by the Company’s qualified person, David W. Moore, P. Geo., President and CEO of Serengeti Resources Inc who has supervised the preparation of and approved the scientific and technical information in this news release.

ON BEHALF OF THE BOARD

David W. Moore, P. Geo.

President, CEO and Director

Cautionary Statement

This document contains “forward-looking statements” within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration plans and other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations as well as a comprehensive list of risk factors are disclosed in the Company’s documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates change, other than as required by law and readers are further advised not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Serengeti Resources Inc. Suite 520 – 800 West Pender St., Vancouver, BC, V6C 2V6

Tel: 604-605-1300 / Email: moc.secruoseritegneres@ofni / Website: www.serengetiresources.com