News

Kwanika Copper Corporation Drills 500 Metres of 0.66% Cu, 0.80g/t Au (2.19 g/t Au Eq) Including 113 Metres of 1.31% Cu, 1.31 g/t Au (4.09 g/t Au Eq) from near surface at Kwanika

November 13, 2018

Vancouver, B.C., November 13, 2018. Serengeti Resources Inc. (SIR: TSX-V) ("Serengeti" or "the Company") is pleased to report the second batch of assay results from the 2018 drilling campaign completed at the Kwanika Project in north-central BC. The fully funded 2018 drilling program is part of the ongoing Kwanika Pre-Feasibility Study (“PFS”) scheduled for completion in mid-2019, as described in Serengeti Resources’ press release dated September 11th, 2018. Kwanika Copper Corporation (“KCC”), is a private company jointly owned by SERENGETI RESOURCES Inc. (65%) and POSCO DAEWOO Corporation (35%).

“These most recent results continue to demonstrate the terrific potential of the Kwanika project. The current holes encountered generally higher grades than we would have predicted from the prior PEA resource model and further demonstrate that our strategic objective of increasing both the resource grade and tonnage of the Central Zone at Kwanika is a reasonable objective of the current program. Furthermore, the holes in the current release demonstrate the potential to expand the open pit-able portion of the deposit” stated David W Moore, President & CEO of Serengeti and President of Kwanika Copper Corp.

Project Highlights

- K-182: 0.80 g/t Au, 0.66% Cu, 2.24 g/t Ag (2.19 g/t AuEq) over 500.3 m, from 25.00 to 525.3 m

- Including 1.3 g/t Au, 1.3% Cu, 4.12 g/t Ag (4.09 g/t AuEq) over 113.0 m, from 25.00 to 138.0 m

- K-187: 0.66 g/t Au, 0.59% Cu, 2.03 g/t Ag (1.91 g/t AuEq) over 226.4 m, from 24.8 to 251.2 m

- Including 1.57 g/t Au, 1.05% Cu, 3.75 g/t Ag (3.81 g/t AuEq) over 75.4 m, from 24.8 to 100.2 m

See attached plan and drill sections or view them on the company’s website at https://www.serengetiresources.com/projects/kwanika/. Results remain pending for an additional 8 holes which have been submitted for assay and will be released in batches as additional results become available

|

Table 1: Kwanika Drill Program - Reported Analytical Results Current Release |

|||||||||||

|

Hole |

Interval |

From (m) |

To (m) |

Interval (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

AuEq (g/t) |

Comments |

|

|

K-182 |

Interval |

25.00 |

525.30 |

500.30 |

0.66 |

0.80 |

2.24 |

1.05 |

2.19 |

OP, UG domains |

|

|

Including |

25.00 |

277.25 |

252.25 |

0.91 |

1.06 |

2.88 |

1.44 |

2.99 |

OP, UG domains |

|

|

|

Including |

25.00 |

138.00 |

113.00 |

1.31 |

1.31 |

4.12 |

1.97 |

4.09 |

OP domain |

|

|

|

K-183 |

Interval |

375.90 |

395.60 |

19.70 |

0.19 |

0.23 |

0.64 |

0.31 |

0.64 |

|

|

|

Interval |

407.40 |

719.40 |

312.00 |

0.45 |

0.73 |

1.75 |

0.81 |

1.69 |

May extend UG domain |

|

|

|

Including |

453.50 |

601.85 |

148.35 |

0.57 |

0.97 |

1.88 |

1.05 |

2.18 |

UG domain |

|

|

|

Including |

474.10 |

557.85 |

83.75 |

0.92 |

1.44 |

2.86 |

1.63 |

3.38 |

UG domain |

|

|

|

K-184 |

Interval |

22.80 |

192.00 |

169.20 |

0.25 |

0.58 |

1.19 |

0.53 |

1.11 |

May extend OP domain |

|

|

Including |

22.80 |

154.30 |

131.50 |

0.28 |

0.60 |

1.22 |

0.58 |

1.2 |

OP domain |

|

|

|

Including |

22.80 |

90.20 |

67.22 |

0.41 |

0.75 |

1.84 |

0.78 |

1.63 |

OP domain |

|

|

|

Including |

22.80 |

38.62 |

15.82 |

1.24 |

1.59 |

5.79 |

2.04 |

4.25 |

OP domain |

|

|

|

Interval |

289.92 |

415.90* |

125.98 |

0.30 |

0.32 |

1.00 |

0.46 |

0.95 |

May extend OP domain |

|

|

|

K-185 |

Interval |

34.50 |

256.40 |

221.90 |

0.44 |

0.61 |

1.96 |

0.75 |

1.55 |

May extend OP domain |

|

|

Including |

34.50 |

175.00 |

140.50 |

0.51 |

0.73 |

2.16 |

0.88 |

1.82 |

OP domain |

|

|

|

Including |

34.50 |

56.90 |

22.40 |

0.77 |

1.38 |

3.69 |

1.45 |

3.02 |

OP domain |

|

|

|

Interval |

288.35 |

320.60* |

32.25 |

0.13 |

0.11 |

0.70 |

0.19 |

0.4 |

|

||

|

K-187 |

Interval

|

24.80 |

251.20* |

226.40 |

0.59 |

0.66 |

2.03 |

0.92 |

1.91 |

May extend OP domain |

|

|

Including |

24.80 |

155.20 |

130.40 |

0.84 |

1.05 |

2.94 |

1.37 |

2.84 |

OP domain |

|

|

|

Including |

24.80 |

100.20 |

75.40 |

1.05 |

1.57 |

3.75 |

1.83 |

3.81 |

OP domain |

|

|

Intercept lengths in the table above are not necessarily true widths given the fact that holes are being drilled at different angles through forecast mining shapes within a variably oriented mineralized body. Gold and Copper equivalents are calculated using the formulae below based on metal prices of $3.00/lb of copper, $1,200/oz of gold and $15/oz of silver, with all metal prices quoted in USD. Metal recoveries as stated in the PEA as follows; Cu 91%, Au 75%, Ag 75% have been applied to the equivalent calculations..* End of Hole.

AuEq = Augpt + ((Aggpt/31.1034*AgPrice*AgRecovery)+(Cu%*CuPrice*CuRecovery*22.0462))/(Augpt/31.1034*AuPrice*AuRecovery)

CuEq = Cu% + ((Augpt/31.1034*AuPrice*AuRecovery)+(Aggpt/31.1034*AgPrice*AgRecovery))/(CuPrice*CuRecovery*22.0462)Open pit (Opit), and Underground (Ug) domains are as outlined in the Company’s NI-43-101 Technical Report for the Kwanika Property, Preliminary Economic Assessment Update 2017, dated 19 April, 2017 and filed on SEDAR and on the Company’s website.

|

Table 2: Kwanika Drill Hole Parameters |

|||||||

|

Hole number |

Azimuth (degrees) |

Dip (degrees) |

Length (m) |

Elevation (m) |

UTM E |

UTM N |

Purpose |

|

K-182 |

181.3 |

-74.6 |

551.0 |

999 |

351499 |

6156313 |

Test S wall of OP; tall stope extraction level |

|

K-183 |

338.9 |

-59.8 |

758.0 |

991 |

351407 |

6155923 |

Test W cave development level |

|

K-184 |

359.8 |

-54.9 |

415.9 |

999 |

351535 |

6156316 |

Test N wall of OP |

|

K-185 |

280 |

-68 |

320.6 |

999 |

351526 |

6156313 |

Test W wall of OP |

|

K-187 |

70.3 |

-72.2 |

251.2 |

999 |

351533 |

6156311 |

Test E wall of OP |

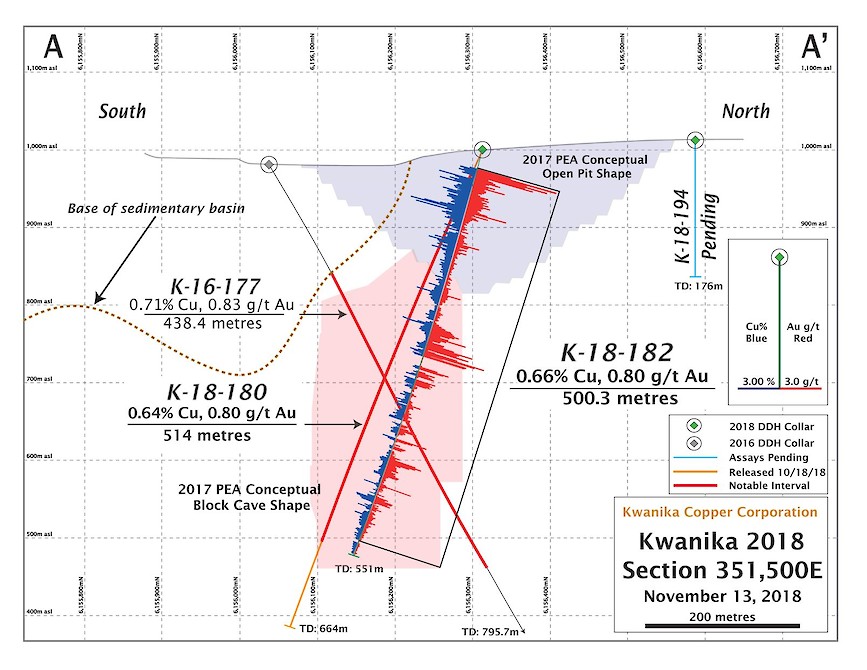

DDH-K-182 was drilled in a southerly direction and was planned to test the south wall of the potential open pit and extend through the potential tall stope to the underground extraction level. K-182 encountered a significant interval of strongly quartz-chalcopyrite veined monzonite from sub-crop beneath a layer of glacial till within the proposed pit as well as a substantial gold-copper rich interval within the potential underground development before terminating at or near the potential extraction level. The hole intersected mineralization within the current PEA mining shapes over a vertical range of 475 m and at the mid point of the tall stope was 45m distant from previously released hole K-180.

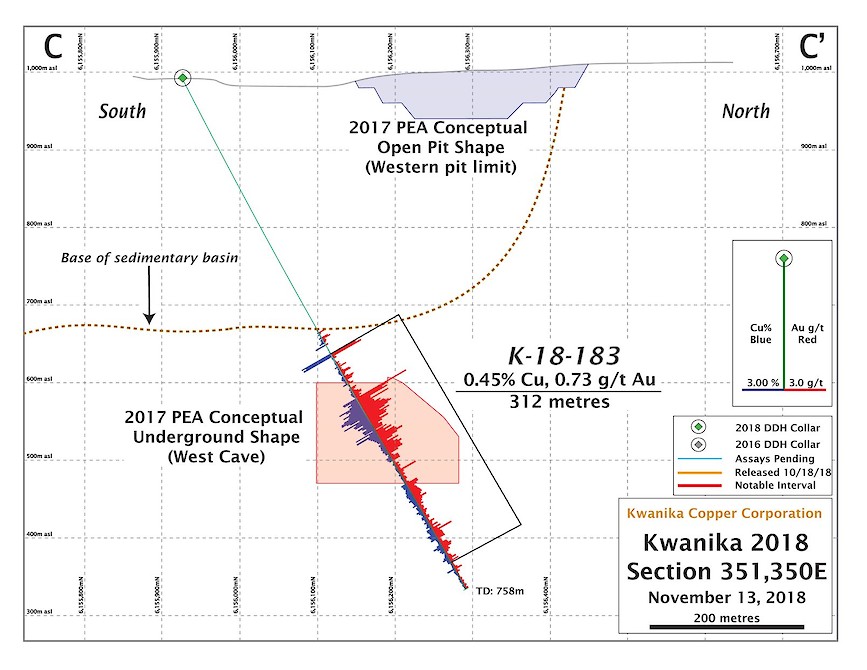

DDH-K-183 was drilled in a north-northwest direction from the south side of the Central Zone, through the sedimentary rock basin that overlies the deposit and was planned to test the west cave and extend through the underground extraction level and continue into the deep footwall. K-183 encountered a supergene copper-enriched zone with native copper gradational to underlying chalcocite overlying a strongly quartz-chalcopyrite veined hypogene zone. The hole intersected significant mineralization for 46 m above and 118 m (drilled lengths) below the currently modelled west stope.

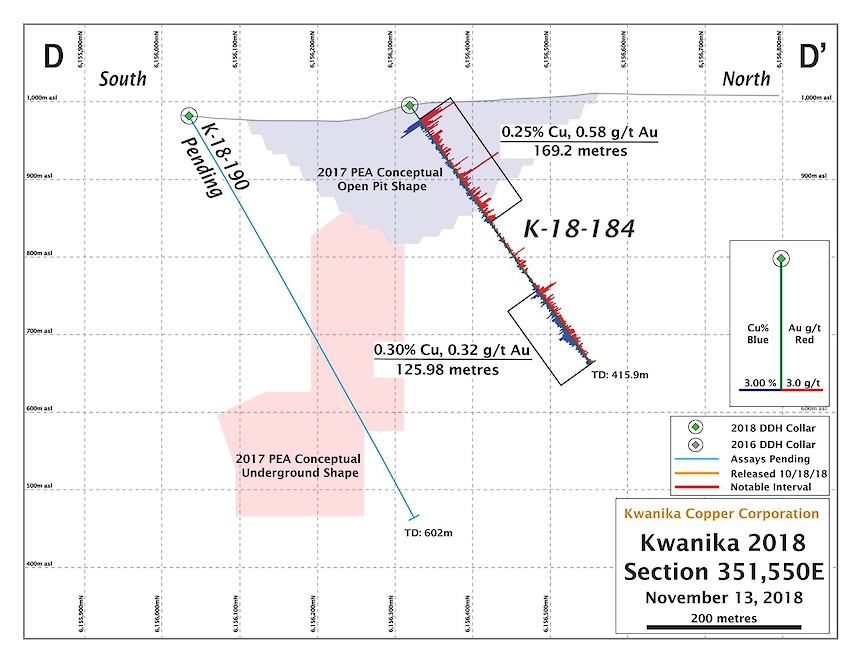

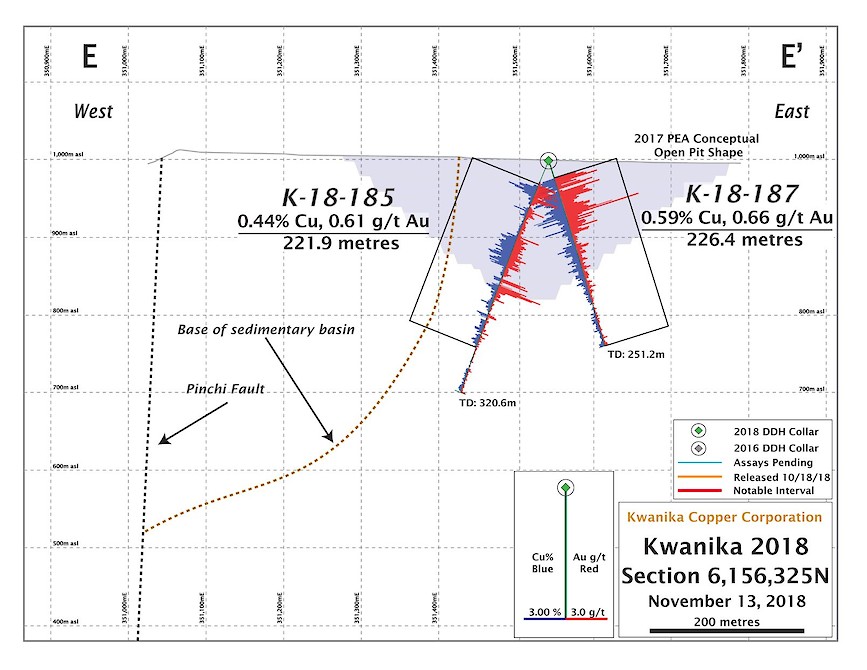

DDH-K-184, 185, 187 were drilled from a common setup to test the north, west and east walls respectively of the open pit domain established in the prior PEA. All three holes encountered variable lengths of strongly quartz chalcopyrite, plus or minus bornite veined monzonite with strong copper-gold grades immediately below the overburden, which when combined with similar mineralization encountered in K180 and 182, appears to establish a generally E-W striking, steeply dipping, high grade domain within the potential pit with an estimated horizontal width of approximately 70 m. All three holes also encountered significant mineralized intervals outside of the current PEA pit ranging from 30 m in K184, to 80 m in K185 and 95 m drilled length in K187. Furthermore, K187 which was mineralized throughout its drilled length remains open to the east at depth and K184 encountered a second deeper mineralized interval that remains open to the north at the bottom of the hole.

About Serengeti Resources Inc.

Serengeti is a mineral exploration company managed by an experienced team of professionals with a solid track record of exploration success. The Company is currently advancing its Kwanika copper-gold project in partnership with POSCO DAEWOO Corporation and exploring its extensive portfolio of properties in north-central British Columbia. A number of these other projects are available for option or joint venture and additional information can be found on the Company’s website at www.serengetiresources.com.

Quality Assurance/Quality Control

Sample analysis for the 2018 Kwanika drilling program was completed at Bureau Veritas Minerals Laboratory in Vancouver, BC, which is ISO 9001:2015 and 17025 accredited. A robust quality assurance/quality control program was completed by KCC which included inserting field blanks, standards and duplicates into the sample stream before being shipped to the laboratory. QAQC samples accounted for a minimum of 20% of the samples which were analyzed in addition to the laboratory’s own quality assurance program. Copper and silver analyses were determined by AQ 270 which is a combined ICP-ES/MS method following Aqua-Regia digestion and is capable of determining up to 100,000 ppm Cu and 1,000 ppm Ag; Au was determined by FA430, a lead collection, Fire Assay/AAS method using a 30 gram sub-sample and has an upper detection limit of 10 ppm Au. The field program was supervised by Serengeti Resources Inc. staff and the technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101, and reviewed by the Company’s qualified person, David W. Moore, P. Geo., President and CEO of Serengeti Resources Inc, who has supervised the preparation of and approved, the scientific and technical information in the news release.

ON BEHALF OF THE BOARD

David W. Moore, P. Geo.

President, CEO and Director

Cautionary Statement

This document contains “forward-looking statements” within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration plans and other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations as well as a comprehensive list of risk factors are disclosed in the Company’s documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates change, other than as required by law and readers are further advised not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Serengeti Resources Inc. Suite 520 – 800 West Pender St., Vancouver, BC, V6C 2V6

Tel: 604-605-1300 / Email: moc.secruoseritegneres@ofni / Website: www.serengetiresources.com