News

Serengeti Drills 212 Metres of 0.40% Cu, 0.08 g/t Au (0.46% CuEq) Including 79 Metres of 0.54% Cu, 0.14 g/t Au (0.64% CuEq) Expanding Central Zone

February 2, 2021

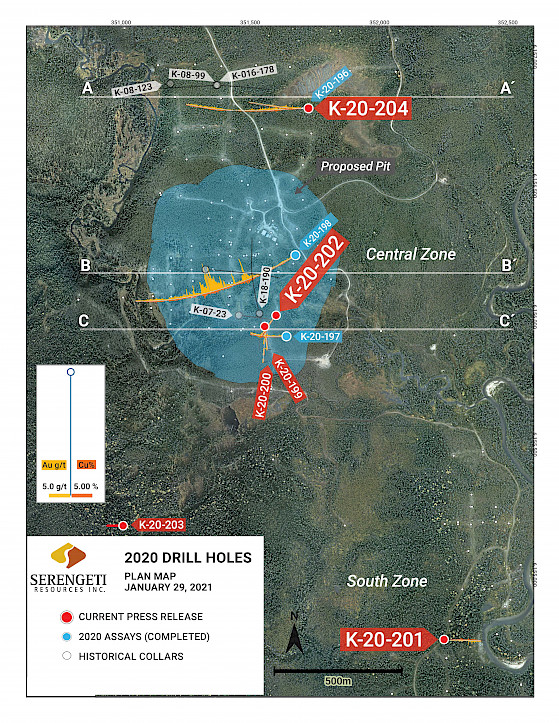

Vancouver, B.C., February 2, 2021. Serengeti Resources Inc. (SIR: TSX-V) ("Serengeti" or "the Company") is pleased to report the final batch of assay results from the 2020 drilling campaign completed at the Kwanika Project in north-central BC. A total of 4,350 metres were drilled in 9 holes testing a number of exploration targets and resource expansion opportunities. The first batch of results were reported on December 16th, 2020. The advanced resource-stage Kwanika project is ~26,000 hectares, held by Kwanika Copper Corporation (KCC)*, and is located in the Quesnel Trough of British Columbia which hosts numerous porphyry copper-gold deposits.

"The 2020 drilling program at Kwanika was a success. K-202 from the current release, combined with previously released K-197, demonstrates that the Central Zone remains open for expansion towards the south along the controlling Central Fault into an area of very sparse drilling. Earlier released hole, K-198 intersected two substantial intervals of well above deposit average grade, demonstrating the potential for delineation of higher grade domains within the known resource and drilling to the north indicates that the mineralized envelope remains open in that direction. We look forward to pusuing all of these opportunities in 2021 under the banner of a strengthened corporate entity, once the merger with Sun Metals has been approved by shareholders." , stated David W. Moore President & CEO of Serengeti Resources.

Project Highlights

- K-201: 0.14% Cu, 0.08 g/t Au, 1.5 g/t Ag and 0.01% Mo (0.23% CuEq) over 120.1 m, from 59.81 to 179.9 m

- Including 0.21% Cu, 0.07 g/t Au, 1.9 g/t Ag and 0.03% Mo (0.33% CuEq) over 45.6 m, from 59.8 to 105.4 m

- Confirms continuity of Cu-Mo-Ag mineralization along west edge of South Zone resource.

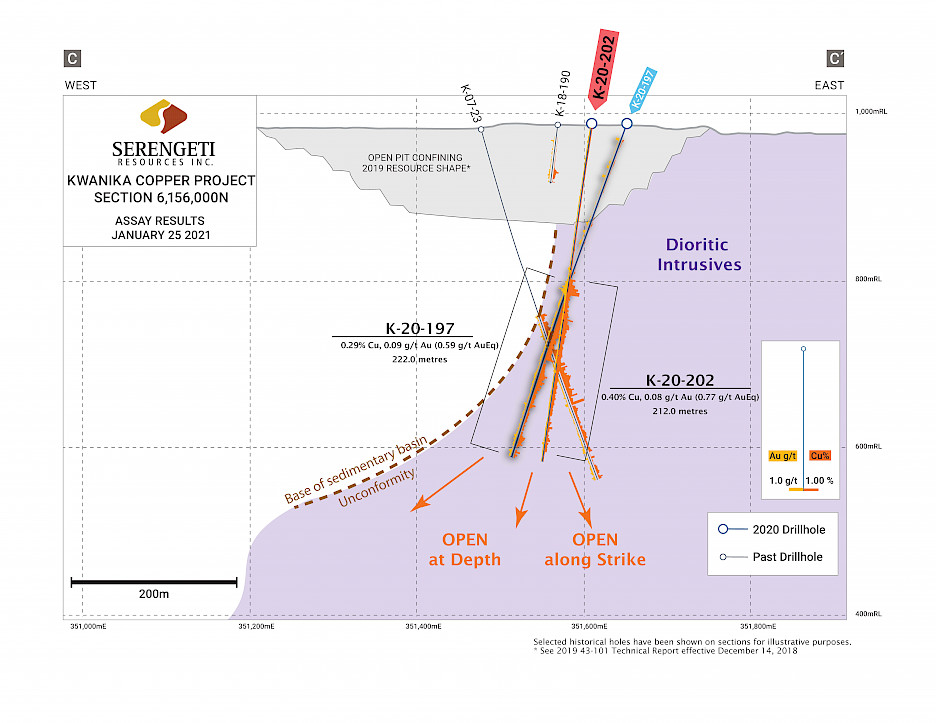

- K-202: 0.40% Cu, 0.08 g/t Au, 1.7 g/t Ag (0.46% CuEq) over 212.0 m, from 201.5 to 413.5 m

- Including 0.54% Cu, 0.14 g/t Au, 2.3 g/t Ag (0.64% CuEq) over 79.1 m, from 201.5 to 280.6 m

- Opens up the Central Zone for expansion below and to the south of current pit constrained resource.

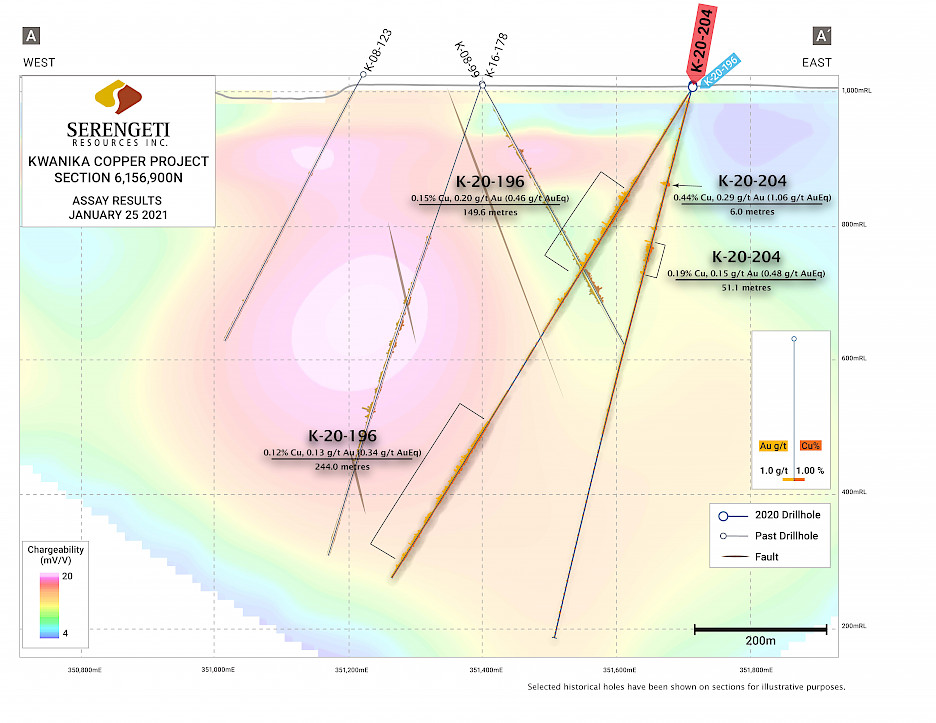

- K-204: 0.19% Cu, 0.15 g/t Au, 1.0 g/t Ag (0.29% CuEq) over 51.1 m, from 242.7 to 293.8 m

- Including 0.33% Cu, 0.19 g/t Au, 1.1 g/t Ag (0.44% CuEq) over 23.0 m, from 249.8 to 272.8 m

- Intersected similar upper mineralized horizon as K-196; ended in dyke swarm interpreted to lie east of mineralized domain

See attached plan and drill sections or view them on the company's website at https://www.serengetiresources.com/projects/kwanika-2/.

|

Table 1: 2020 Kwanika Drill Program - |

||||||||

|

Hole |

From |

To |

Interval |

Cu |

Au |

Ag |

CuEq |

AuEq |

|

K-199 |

No significant values |

|||||||

|

K-200 |

No significant values |

|||||||

|

K-201 |

59.8 |

179.9 |

120.1 |

0.14 |

0.08 |

1.5 |

0.23A |

0.38B |

|

Including |

59.8 |

105.4 |

45.6 |

0.21 |

0.07 |

1.9 |

0.33A |

0.56B |

|

K-202 |

201.5 |

413.5 |

212.0 |

0.40 |

0.08 |

1.7 |

0.46 |

0.77 |

|

Including |

201.5 |

280.6 |

79.1 |

0.54 |

0.14 |

2.3 |

0.64 |

1.08 |

|

K-203 |

No samples submitted to lab |

|||||||

|

K-204 |

150.0 |

156.0 |

6.0 |

0.44 |

0.29 |

1.9 |

0.63 |

1.06 |

|

And |

242.7 |

293.8 |

51.1 |

0.19 |

0.15 |

1.0 |

0.29 |

0.48 |

|

Including |

249.8 |

272.8 |

23.0 |

0.33 |

0.19 |

1.1 |

0.44 |

0.75 |

Intercept lengths in the table above are not necessarily true widths given the fact that holes are being drilled at different angles through forecast mining shapes within a variably oriented mineralized body. Gold and Copper equivalents are calculated using the formulae below based on metal prices of $3.25/lb of copper, $1,600/oz of gold, $20/oz of silver and $11/lb of molybdenum, with all metal prices quoted in USD. Metal recoveries as stated in the PEA as follows; Cu 91%, Au 75%, Ag 75% have been applied to the equivalent calculations. ** End-of-hole.

CuEq = Cu% + ((Augpt/31.1034*AuPrice*AuRecovery)+(Aggpt/31.1034*AgPrice*AgRecovery))/(CuPrice*CuRecovery*22.0462)

AuEq = Augpt + ((Aggpt/31.1034*AgPrice*AgRecovery)+(Cu%*CuPrice*CuRecovery*22.0462))/(Augpt/31.1034*AuPrice*AuRecovery)

CuEq and AuEq values for South Zone hole K-201 are calculated including Mo assuming a recovery of 60%, as follows:

A CuEq = Cu% + ((Augpt/31.1034*AuPrice*AuRecovery)+(Aggpt/31.1034*AgPrice*AgRecovery))+(Mo%*MoPrice*MoRecovery*22.0462))/(CuPrice*CuRecovery*22.0462)

B AuEq = Augpt + ((Aggpt/31.1034*AgPrice*AgRecovery)+(Cu%*CuPrice*CuRecovery*22.0462)+(Mo%*MoPrice*MoRecovery*22.0462))/(Augpt/31.1034*AuPrice*AuRecovery)

|

Table 2: Kwanika 2020 Drill Hole Parameters Current Release |

|||||||

|

Hole |

Azimuth |

Dip |

Length |

Elev. |

NAD83 |

NAD83 |

Target |

|

K-199 |

173 |

-60 |

173.2 |

985 |

351568 |

6156034 |

Central Zone/ |

|

K-200 |

183 |

-60 |

278.2 |

985 |

351568 |

6156034 |

Central Zone/ |

|

K-201 |

090 |

-45 |

202.0 |

1010 |

352263 |

6154825 |

West edge of South Zone resource |

|

K-202 |

215 |

-75 |

425.5 |

993 |

351609 |

6156078 |

Central Zone/ |

|

K-203 |

270 |

-70 |

179.1 |

1026 |

351000 |

6155267 |

Pinchi South ZTEM target |

|

K-204 |

268 |

-75 |

851.5 |

1011 |

351714 |

6156881 |

Central Zone/ |

DDH-K-199 deviated from the planned orientation more than anticipated, intersecting propylitically altered barren diorite and granodiorite before being abandoned at 173.2m. The drill was then repositioned to drill K-200.

DDH-K-200 intersected complex intrusive and structural breccias dominated by chlorite-magnetite propylitic and patchy weak potassic alteration with trace chalcopyrite. Locally strong sericite alteration and pyrite overprinting suggest the hole intersected a structural zone that served as a conduit for later Cu-diluting fluids.

DDH-K-201 was drilled across the west edge of the South Zone resource to test and confirm grade continuity along the West Fault. The hole intersected near-surface disseminated and vein chalcopyrite-molybdenite mineralization within silica altered quartz-syenite east of the West Fault, confirming continuity of grade along the west edge of the South Zone deposit.

DDH-K-202 was drilled to follow up on encouraging results from K-23, K-190 and K-197 along the Central Fault south of the Central Zone deposit. The hole drilled through the Central Fault intersecting potassically-altered diorite hosting chalcopyrite ± chalcocite ± bornite mineralization immediately west of the Central Fault and below the unconformity with the sedimentary basin. The hole confirmed that the Central Fault is a major controlling structure on mineralization, and that the Central Zone system remains open along the fault, and at depth beneath the sedimentary basin. Drill hole density south of K-202 is sparse and potential exists to expand the Central Zone southward from current resource boundaries.

DDH-K-203 was an exploration hole drilled to test a Z-Axis Tipper Electromagnetic (ZTEM) and coincident Ah-horizon soil geochemical anomaly southwest of the Central Zone along the Pinchi Fault. The hole intersected interbedded mafic volcanics and calcareous sediments of the Cache Creek terrane which explain the geophysical response. The hole was abandoned at 179.1 metres and no samples were submitted to the laboratory for analysis.

DDH-K-204 was drilled to follow up on encouraging results from K-196, including two mineralized horizons. K-204 intersected potassically altered diorite and monzodiorite hosting pyrite-chalcopyrite mineralization similar to the upper mineralized horizon in K-196 before entering a barren gabbroic-granitic dyke swarm showing complex cross-cutting relationships. The dyke swarm may represent a high-temperature intrusive system core possibly related to Central Zone mineralization. When coupled with mineralized intercepts from prior drill holes to the west and north, this suggests a mineralized system may continue at depth toward the northwest.

* Serengeti sole-funded the 2020 Kwanika program. As a consequence, the Company's ownership of KCC increased to ~ 67%, with POSCO International Corp. holding ~33%.

Top Cat

During June 2020, Serengeti completed a 2-week grid mapping and sampling program at Top Cat to follow up on encouraging results from 2019 including 1.39% Cu, 0.69 g/t Au and 1.38 g/t Pd (see press release dated January 19, 2020) at the Nova area. A total of 92 rock samples, 409 Ah soil samples and 55 stream sediment samples were collected over the area followed by a reconnaissance induced-polarization ("IP") survey totaling 15 line-km in four lines over areas of interest. As a result of the work, a number of alkalic porphyry Cu-Au targets were identified characterized by polymetallic soil and coincident IP anomalies within intrusive rocks of the Duckling Creek suite. The Nova area is now considered drill-ready.

Top Cat is under option from the Pinchi Group (see Serengeti press release dated July 23rd, 2019) and covers approximately 26,000 hectares in north-central BC. The property adjoins Sun Metals' wholly-owned 39,000 hectare Lorraine property (see Sun Metals press release dated November 26, 2020), which hosts a historical NI43-101 mineral resource. Lorraine has been the focus of past academic research and hosts a number of alkalic porphyry Cu-Au prospects and occurrences, and the overall prospective trend continues onto the Top Cat property. Top Cat and Lorraine may be integrated as a result of the proposed merger between Serengeti and Sun Metals, announced on November 30th, 2020. A comprehensive historical data compilation and targeting exercise is currently underway for the Top Cat – Lorraine tenures, and the Company is planning a significant target development program in 2021 for the combined properties to identify targets for future drilling.

Quality Assurance/Quality Control

Sample analysis for the 2020 Kwanika drilling program was completed at Bureau Veritas Minerals Laboratory in Vancouver, BC, which is ISO 9001:2015 and 17025 accredited. A robust quality assurance/quality control program was completed which included inserting field blanks, standards and duplicates into the sample stream before being shipped to the laboratory. QAQC samples accounted for a minimum of 10% of the analyzed samples in addition to the laboratory's own quality assurance program. Copper and silver analysis were determined by MA200 in exploration samples, and MA300 for resource and near-resource samples. MA200 is a combined ICP-ES/MS method following 4-acid (MA) digestion with detection ranges of 0.1 – 10,000ppm for Cu, and 0.1 – 200ppm for Ag. MA300 is an ICP-ES method following a 4-acid (MA) digestion with detection ranges of 2 – 10,000ppm for Cu, and 0.5 – 200ppm for Ag. Overlimit analysis for Cu were determined by MA370, an ICP-ES method following 4-acid (MA) digestion with detection ranges of 0.001 – 10%. Gold was determined by FA430, a lead collection, Fire Assay/AAS method using a 30 gram sub-sample with detection ranges of 0.005 – 10ppm.

Qualified person

The field and analytical programs described herein were supervised by Serengeti Resources staff and the technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101, and reviewed by the company's qualified person, Quinn Harper, P.Geo., Chief Geologist of Serengeti Resources, who has supervised the preparation of, and approved the scientific and technical information in this news release.

ON BEHALF OF THE BOARD

David W. Moore, P. Geo.

President, CEO and Director

About Serengeti Resources Inc.

Serengeti is a mineral exploration company managed by an experienced team of professionals with a solid track record of exploration success.

Serengeti and Sun Metals Corp announced on November 30th, 2020 that they have entered into a definitive arrangement agreement pursuant to which Serengeti will acquire all of the issued and outstanding shares of Sun Metals Corp. The combined company will result in a diversified copper-gold developer with a large pipeline of projects, in one of Canada's most prolific porphyry mining camps in North-Central BC, bringing together exploration, development and operational synergies at multiple projects along with ongoing resource expansion opportunities and new discovery potential. Additional information can be found on the Company's website at www.serengetiresources.com.

Cautionary Statement

This document contains "forward-looking statements" within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration plans and other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations as well as a comprehensive list of risk factors are disclosed in the Company's documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates change, other than as required by law and readers are further advised not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Serengeti Resources Inc. Suite 520 – 800 West Pender St., Vancouver, BC, V6C 2V6

Tel: 604-605-1300 / Email: moc.secruoseritegneres@ofni / Website: www.serengetiresources.com

Cross Section K-20-197 and K-20-202